lL-PESA #ICO

L-Pesa is a financial technology platform that provides new financial tools for consumers and small businesses in Africa and Asia. We enable people to create opportunities for themselves and their families. Borrowers on the L-Pesa platform use the means to start or grow a business, pay for education or maintain their ambitions in life. Using a special token in a block chain means that all investors can benefit from capital gains caused by network effects. Coins are limited inventory, and when L-Pesa expands, people can pay their coins with coins. People will also be able to use LPK to buy goods and services.

All about L-pesa

L-Pesa Microfinance is the beginning of fintech, ready to take advantage of the rapidly growing need for financial services in the developing world. The company tested its operating model over the last 18 months and built advanced technology, which automates a lot of work. The main obstacle to current growth is its ability to finance user acquisitions and loans.

The loan loss ratio is less than 10%, and the loan proceeds

about 25%.

The idea of L-Pesa was incubated for a decade, and business was launched at a time when four important market forces united to allow scaling:

Great data, artificial intelligence, and blocking

Alternative credit data

Mobile technology

Biometric identity

L-Pesa uses this market power and builds its own credit scoring technology and model, enabling rapid micro-credit scaling in developing countries, while maintaining a loss rate below 10%. The solution is highly automated, allowing a small group of offices to support large numbers of loans. All loans are serviced by L-Pesa.

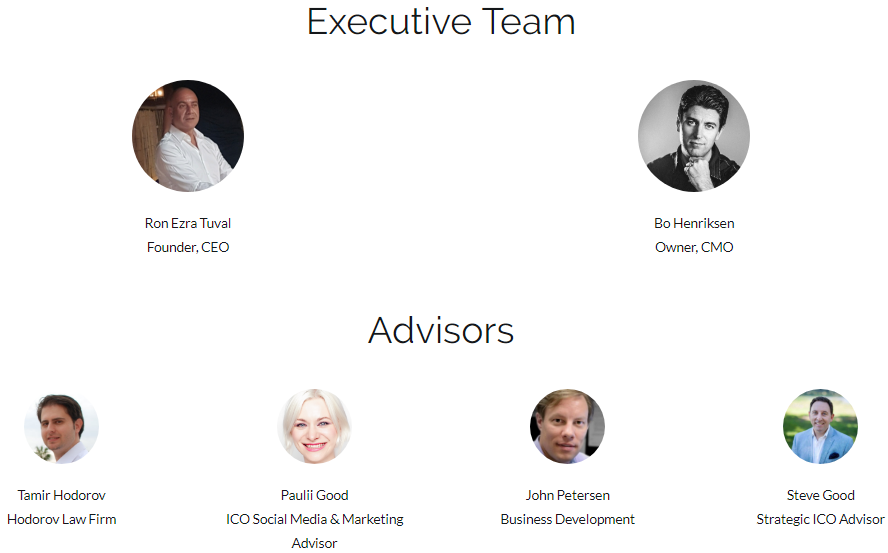

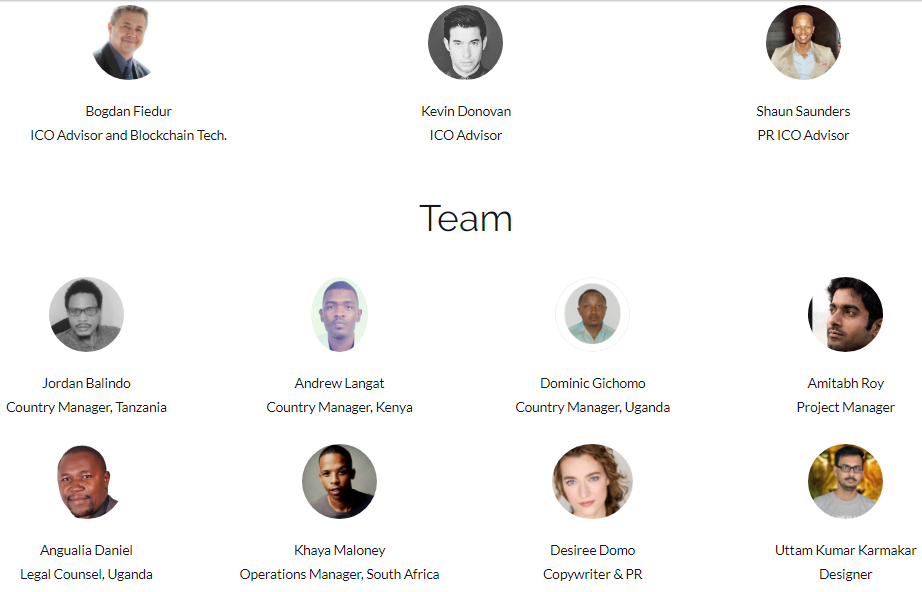

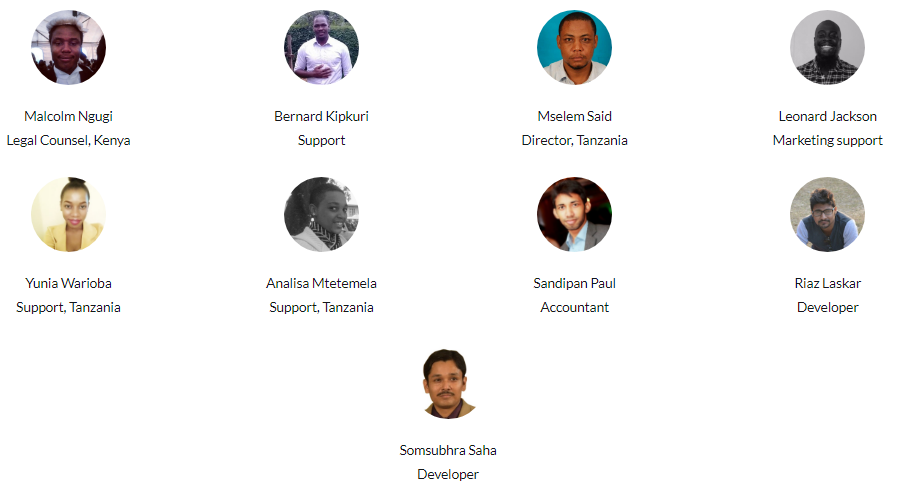

Ron Ezra Tuval, founder and managing director of L-Pesa, has extensive experience in developing countries, particularly those related to agricultural technology and tourism. Ron first met microfinance in Southeast Asia and spent ten years incubating the idea of L-Pesa, awaiting the emergence of the necessary technology. Ron created a strong and diverse team for L-Pesa with national leaders working in Tanzania, Kenya and Uganda, and a development team in India. There are also back-office teams in Tanzania, Kenya and Uganda involved in background checks, credit approvals and customer service. Technology, marketing and accounting groups operate on a virtual model and consist of experienced employees in Europe, the United States and India.

L-Pesa is very concerned about automation. 95% of the process of acquisition and guarantee of automatic users and therefore highly measurable. The company spent two years developing a client and back-office system, using a team of seven software developers. User experience 832754982.1 4

based on mobile and web interfaces, and most marketing is handled through social networking and SMS-based marketing.

The pile of L-Pesa technology builds on Amazon Web Services, a highly scalable on-demand cloud computing platform used or used by major brands like Netflix, Airbnb, Pinterest, and Spotify.

L-Pesa has integrated a number of third-party applications to perform tasks such as SMS messaging, user verification and marketing. Fund transfers are made through integration with mobile money service providers, such as M-Pesa, Tigo Pesa and MTN.

L-Pesa has published over 35,000 loans since its release in March 2016. More than 160,000 registered users are based on social marketing campaigns with a minimum budget. Marketing strategy has been improved over the past 18 months, and L-Pesa is now ready to launch marketing campaigns via SMS and social networking with conservative projected fees to get subscribers by

$ 1.00.

The founders of L-Pesa invested about $ 500,000 to date. The business was launched in Tanzania in 2016 and in Kenya in August 2017.

In Uganda and India there is a launch schedule. Enterprise technology is stable, scalable, verified and will support the company's growth plan. Currently, L-Pesa has fallen into growth barriers - there is not enough money to lend to all those interested, and the potential to get users is virtually unlimited, but requires capital for marketing and staff support costs. Currently, the company is raising funds to take advantage of

leading position, a strong platform and an almost limitless opportunity to expand financial opportunities for most of the world's population.

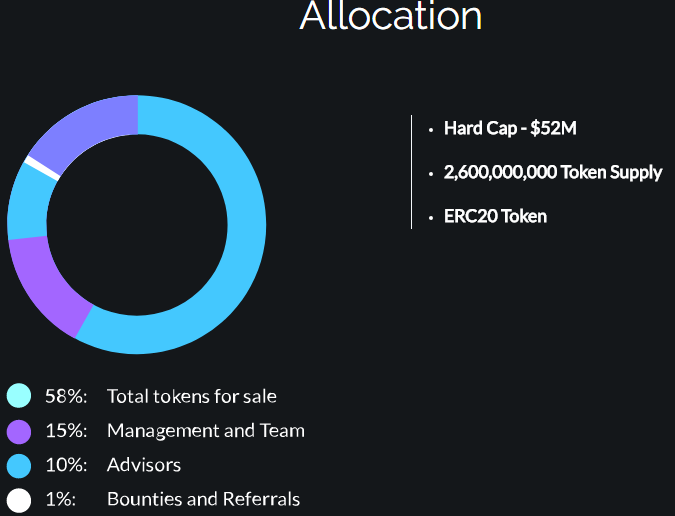

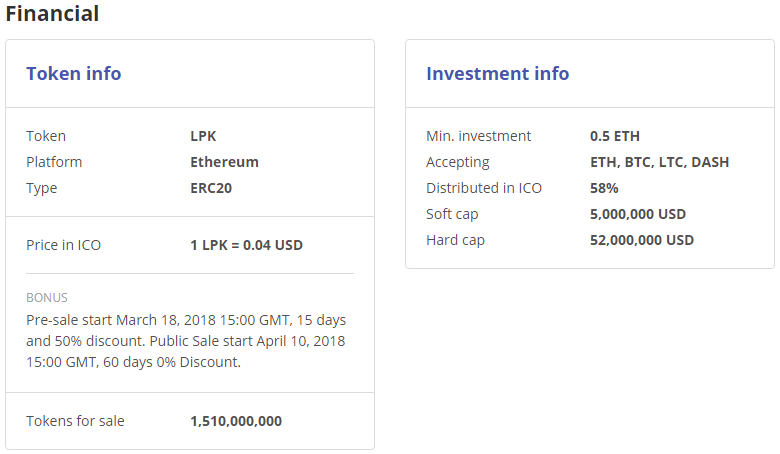

Token LPK

Price 1 LPK = 0.04 USD

Bonus available

Bounty available

Ethereum Platform

Take ETH, BTC, LTC, DASH

Minimum investment of 0.5 ETH

Soft cover $ 5,000,000

Hard cover $ 52,000,000

Country of Gibraltar

Whitelist / KYC KYC & Whitelist

Limited region of China, South Korea, New Zealand

Basic stage

January 2014

Microfinance L-pesa was launched in January 2014. Finally, the idea finally materialized.

2016 - Launch of Tanzania

Tanzania was launched, listed as microfinance L-pesa.

2017 - Started operations in Kenya

Kenya begins in August 2017.

The Company operates as a "L-pesa loan and credit line.

2018 - Launches operation in Uganda

The operation in Uganda began in February 2018.

The Company operates as "L-pesa Microfinance Ltd."

2018 - Launches operations in India

It is expected that Indie exploitation will begin in June 2018.

The Company operates as "Microfinance L-pesa".

2020 It is expected that L-Pesa will reach 100 million subscribers

If you want to join please open the link below,

Details Information:

Website: https://kriptonofafrica.com/

Twitter: https://twitter.com/LPesaMicrofin

Facebook: https://www.facebook.com/kriptonlpk/

Telegram: https://t.me/joinchat/HbNNkBLQJkw7765Ri7tg7w

By. penikmatsenja

BTT : https://bitcointalk.org/index.php?action=profile;u=1251309

ETH: 0x478A431b1644FdC254637d171Fa5663A739f8eF2

BTT : https://bitcointalk.org/index.php?action=profile;u=1251309

ETH: 0x478A431b1644FdC254637d171Fa5663A739f8eF2

Komentar

Posting Komentar